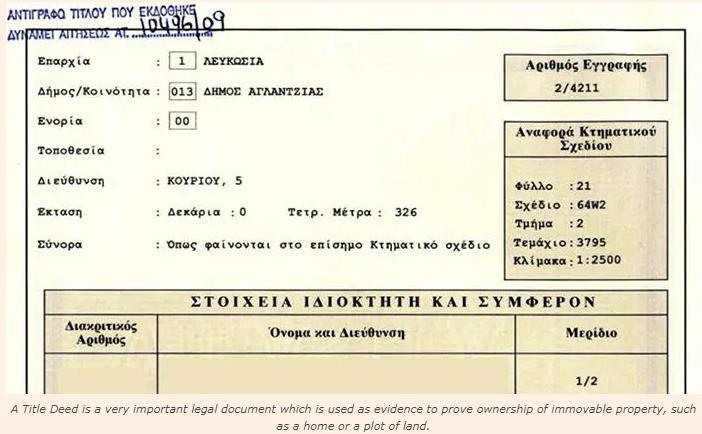

The Certificate of Title is a key document for the owner of real estate or land in Cyprus. It confirms and protects the owner’s rights to a specific property. The buyer can obtain this certificate at the final stage of the purchase transaction. First, it is necessary to reserve the property with the Cyprus Land Committee and pay its full value. The absence of a Certificate of Title can lead to significant problems for the new owner. Without this document, the owner cannot sell, mortgage, or bequeath such property. Only the Certificate of Title in the owner’s name provides full rights to dispose of the property or land.

For a long time, buyers from Russia and England have faced fraud when purchasing property or land without a Certificate of Title. As of 2015, about 30,000 properties do not have a Certificate of Title, and the average time to obtain it ranges from 7 to 25 years.

How long does it take to obtain a Certificate of Title in Cyprus?

It depends on the type of property being purchased. If you are buying a property on the secondary market, the process takes about 1 hour. However, if you are buying a property under construction, it will take longer. The Certificate of Title is issued by regulatory authorities only after the property is fully operational. The inspection is thorough, so it takes from 1 to 4 years.

Some developers mortgage the land to the bank to borrow money for the construction of houses and apartments. However, the problem is that it is impossible to obtain a Certificate of Title while the land is mortgaged. To avoid this situation, it is better to turn to a well-known licensed real estate agency in Cyprus and also seek legal assistance.

What happens to the Certificate of Title of the previous owner?

Nothing happens. It remains with them. A property can have two, three, or more certificates depending on how many owners it had before. But only the latest one, confirmed by registration with the Cyprus Land Committee, is valid.

How much does it cost?

The transfer fee is a property transfer tax in Cyprus. The amount depends on the total value of the property, but buyers of new buildings, who have to pay VAT, are completely exempt from it.

If you have any questions or need professional assistance, you can ask the consultants at Sunny Bay, and you will receive answers to your questions!